A fideicomiso is a bank trust, which is administered on your behalf at a Mexican bank chosen by you . The bank then serves as the trustee while you serve as the beneficiary of the trust. Just as with a beneficiary of a living trust in the United States, you have complete authority over it, exercising your use of the property and making all relevant decisions including the sale of the property.

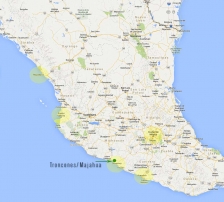

Residential properties outside the restricted zone or beyond 50 km of the coastline do not require a fideicomiso for a foreign acquisition. The Mexican constitution was initially drafted in order to protect loss of land, which resulted in the restricted zone. Afterwards, Mexico then created the fideicomiso in order to promote foreign investment.

The trust established through the fideicomiso does not become part of the bank’s assets. Instead, the bank simply becomes the administrator. As a result, the trust cannot get tied up in any legality issues that may arise with the bank or have a lien placed against it. The trust is established and renewed in 50 year periods with a guarantee of renewal in perpetuity. The cost for the renewal is approximately $500 USD.

If your intentions are to purchase the property and conduct it as a business, then purchasing through a Mexican corporation may be your best option. Common types of corporations include a limited liability (LLC) and a limited liability partnership (LLP). Tax implications in both the US and Mexico can vary between the types of corporations and it is advised that you speak with your attorney or accountant (in both the US and Mexico) to gain a better understanding.

Foreign ownership of property in Mexico is established through the creation of a Mexican corporation. Since 1995, foreigners have been able to establish and own Mexican corporations. In order to establish a foreign corporation in Mexico, two or more individual investors are required. In addition, said investors, when combined, must control 100% of the corporation. None of the investors to the corporation are required to be Mexican. A foreign corporation in Mexico has the legal authority to purchase property, which includes the restricted zone.